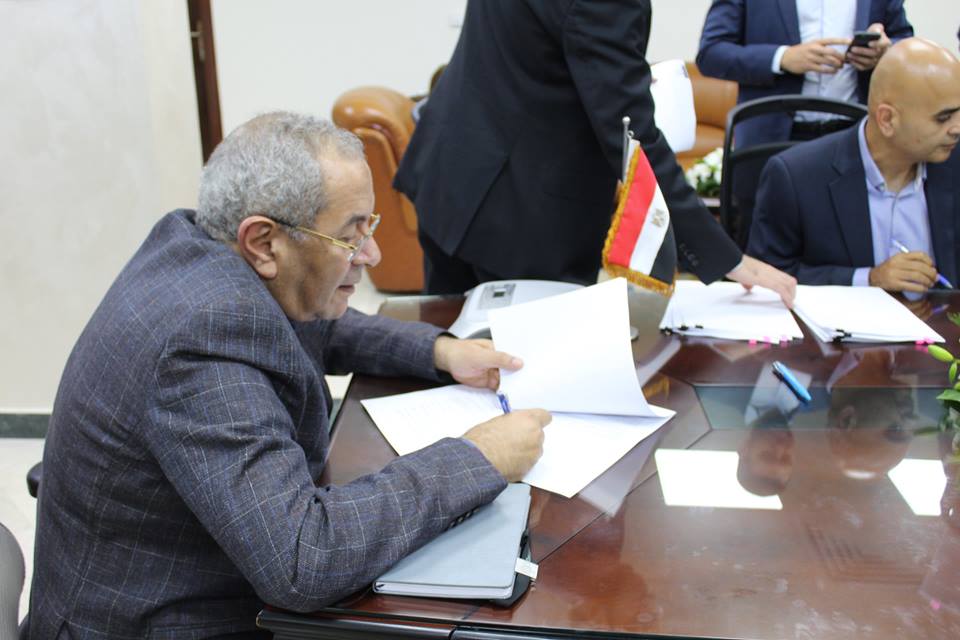

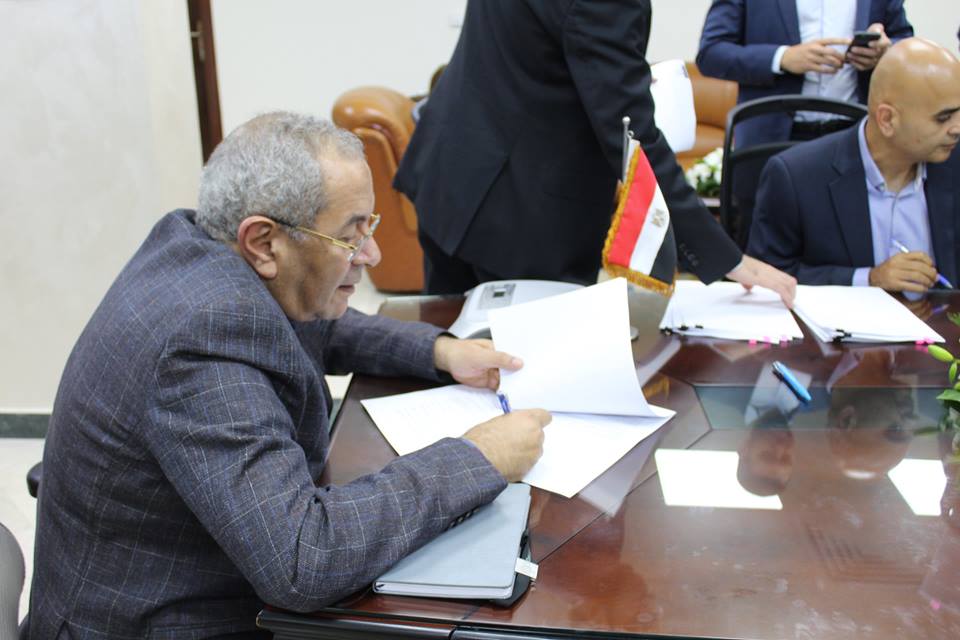

Cairo, Egypt, November 1st, 2017 – The Egyptian-American Enterprise Fund (“EAEF”) announced today that it has entered into binding agreements to acquire a significant minority stake in Orchidia Pharmaceutical Industries the leading Egyptian ophthalmic generic medicine manufacturer and one of the fastest growing pharmaceutical companies in Egypt. The transaction is being executed through EAEF’s investment manager Lorax Capital Partners (“LCP”). The transaction consists of a capital increase that will be subscribed to by EAEF and Dr. Ossama Abbass, the founder, majority shareholder and Chairman of the Company, in addition to acquiring the stake owned by SPE Capital, formerly Swicorp Private Equity as well as a stake owned by other minority shareholders. The proceeds of the capital increase will be used to enhance the capital base of the Company and finance its expansion plans.

We are excited about our partnership with Orchidia and its strong management team led by Dr. Ossama Abbas. Orchidia plays an important role in the Egyptian ophthalmic market by providing high-quality affordable medicine to the Egyptian population. EAEF intends to provide all necessary resources to fully support the company’s future growth plans to cater to the growing Egyptian market as well as develop Egypt’s export potential.” said James A. Harmon, Chairman of EAEF, adding “EAEF is strongly committed to supporting Egypt’s private sector with the goal of enhancing job creation. We hope that our investment would encourage and demonstrate to new foreign investors the significant potential in the Egyptian market.”

Dr. Ossama Abbas, founder and Chairman of Orchidia commented: “A previous couple of years have been really challenging for the pharmaceutical industry in Egypt. However, the Orchidia team was able to capitalize on this opportunity by consistently working hard and focusing on delivering high-quality affordable medicine to the market in addition to opening up key export markets. We are proud of our achievements and are looking forward to our next phase of growth in the local and export markets with the support of our new partners.”

TMS Law Firm acted as the legal advisor to EAEF. Arqaam Capital acted as the financial advisor and DLA Piper acted as the legal advisor to Dr. Ossama Abbas and the Company.

About the Egyptian-American Enterprise Fund:

The Egyptian-American Enterprise Fund is a United States government-funded private entity. Since the inception of the Enterprise Fund Program, over US$ 1.1 billion has been invested directly alongside US$6.9 billion invested by private parallel funds.

With an anticipated capital of up to US$300 million, EAEF is committed to promoting financial inclusion, job creation and increasing foreign and domestic investment in Egypt for long-term sustainable economic development. EAEF’s primary mission is to stimulate the Egyptian private sector by providing access to finance, human capital, modern technologies as well as best business practices while achieving financial profitability.

The fund is led by a board of directors that is primarily comprised of American, Egyptian-American and Egyptian nationals.

Further details on the Egyptian-American Enterprise Fund can be found at http://www.eaefund.org

The U.S. Agency for International Development administers the U.S. foreign assistance program providing economic and humanitarian assistance in more than 80 countries worldwide.

This press release about an EAEF investment is made possible by the generous support of the American people through the United States Agency for International Development (USAID). The contents are the responsibility of the Egyptian-American Enterprise Fund and do not necessarily reflect the views of USAID or the United States Government.

About Lorax Capital Partners:

Incorporated in 2015, Lorax Capital Partners (“LCP”) is an Egypt focused private equity firm currently managing the EAEF funds and was responsible for EAEF’s investments in Fawry for Banking and Payment Technology Services, the leading electronic payments platform in Egypt and Sarwa Capital, a pioneer in consumer finance, leasing, and securitization in Egypt. LCP is very well positioned to serve as a ‘bridge’ between Egypt, on the one hand, and global investors that are looking to generate attractive risk-adjusted returns while contributing to the economic development of the country.

LCP’s management team has an unmatched track record in sourcing, executing and managing transactions in Egypt with a combined value of over USD 46 billion.